modified business tax nevada due date

561 the tax rate was scheduled to return to 063 on all quarterly tax wages and the two-tiered structure is eliminated. If you have any questions about federal taxes you can contact the IRS at 800-829-4933.

Nevada Modified Business Tax 2020 2022 Fill And Sign Printable Template Online Us Legal Forms

Get a personalized recommendation tailored to your state and industry.

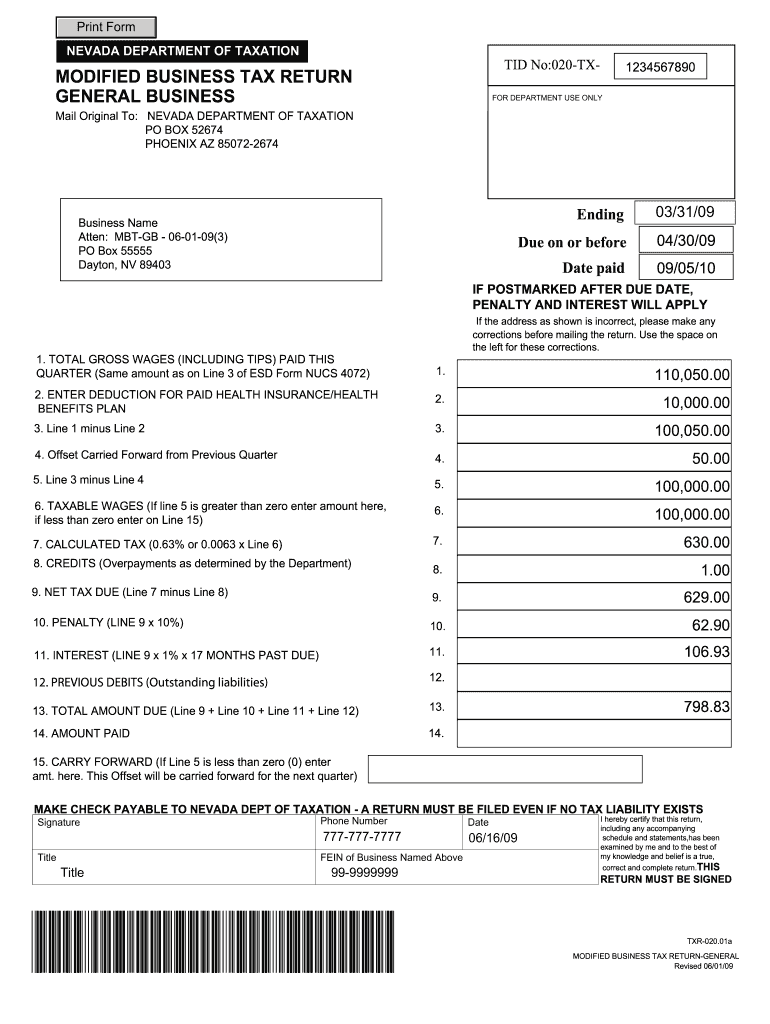

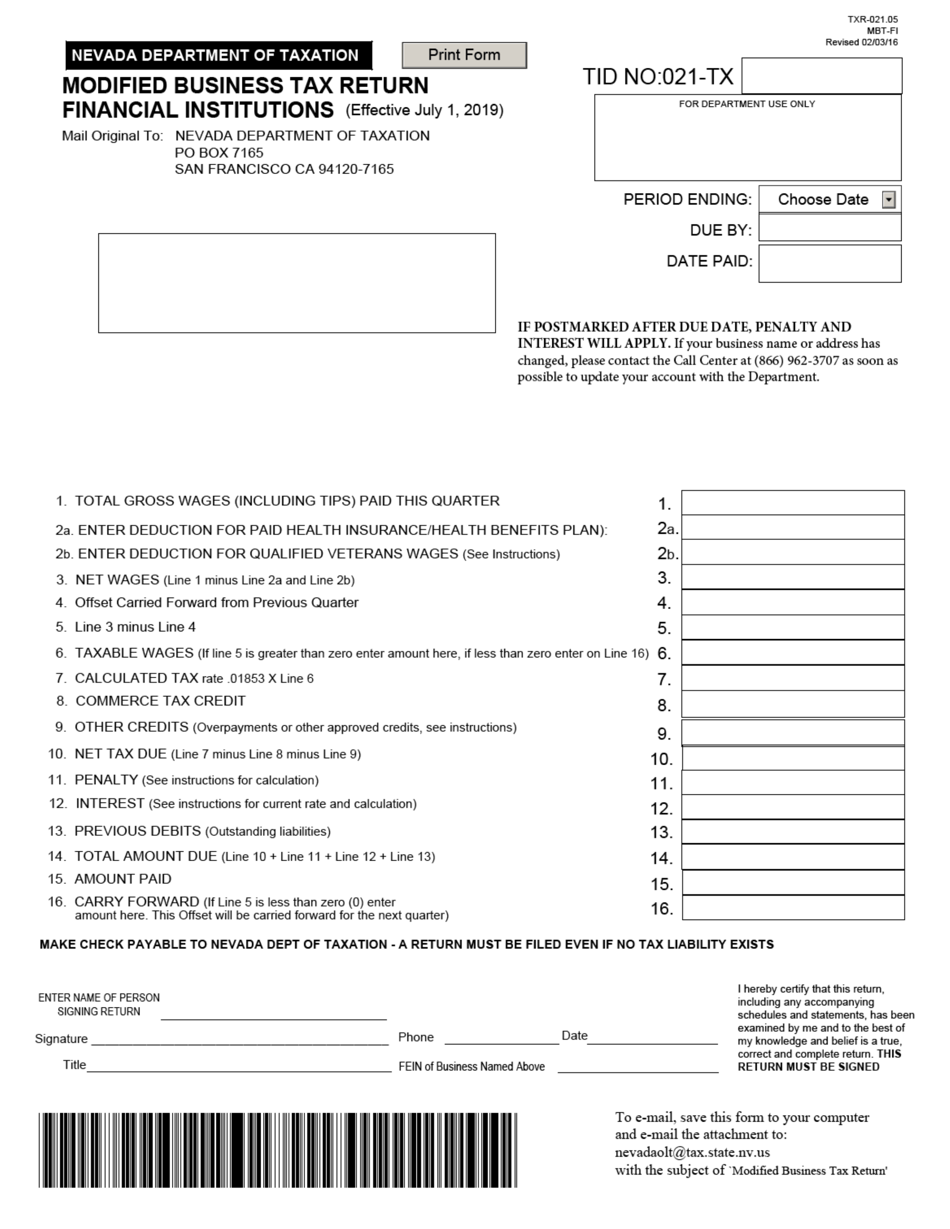

. Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. This is the standard quarterly return for reporting the Modified Business Tax for General Businesses. This typically happens in April July October and especially January which coincides with the due dates of monthly quarterly and sometimes annual returns.

Additionally the new threshold is decreased from 85000 to 50000 per quarter. Generally the due date is August 14. Nevada modified business tax form 2022ne or iPad easily create electronic signatures for signing a nevada modified business tax form in PDF format.

Ad Find out what tax credits you qualify for and other tax savings opportunities. If you have any questions about state taxes you can contact the Nevada Department of Taxation at 866-962-3707. Modified Business Tax NRS 463370 Gaming License Fees NRS 680B.

If the due date falls on a weekend or holiday the return is due on the next business day. Reduction of Modified Business Tax MBT Rates Based on Provisions in NRS 360203 2 By September 30thof each even-numbered year the Department must evaluate whether an adjustment to the Modified Business Tax MBT rate is necessary based upon the amounts collected for both the MBT and the commerce tax in the previous fiscal year. Nevada Tax Notes or in written correspondence BUSINESS TAX - QUESTIONS.

The due dates are April 30 July 31 October 31 and January 31. For additional questions about the Nevada Modified Business Tax see the following page from the State of Nevadas Department of Taxation. Most transactions are available via the online portal SilverFlume and will be processed the same day for no additional charge.

It could take as long as 15 days for your check to clear your account. However before the July 1 2019 rate reduction legislation Senate Bill 551 was enacted that repealed the law reducing the rate. Nevada levies a Modified Business Tax MBT on payroll wages.

To find it go to the App Store and type signNow. The previous tax was set at 117 above an exemption level of 85000 per quarter although certain industries such as financial institutions paid a higher rate. Quarter ended September 30 return is due by October 31 Late filing penalty up to 10 NRS 360417.

Customer Service is available Monday thru Friday 800 am. SB 483 of the 2015 Legislative Session became effective July 1 2015 and changes the tax rate to 1475 from 117. The amnesty period will begin Feb.

Their hours are 7am to 7pm Monday through Friday Pacific Time. If the business ceased to exist before the end of the taxable year a short year return may be filed. The default dates for submission are April 30 July 31 October 31 and January 31.

PdfFiller allows users to edit sign fill and share all type of documents online. Rate the nevada modified business tax due dates. The new law imposes a 1475 MBT after July 1 2015 and lowers the exemption to 50000 per quarter.

Overview of Modified Business Tax. 12 rows Due Date Extended Due Date. If the sum of all taxable wages after health.

Every employer who is subject to Nevada Unemployment Compensation Law NRS 612 is also subject to the Modified Business Tax on total gross wages less employee health care benefits paid by the employer. Federal State Contact Information. Businesses with less than 4 million of Nevada gross receipts are not required.

The MBT rates have remained the same 1475 on taxable wages exceeding 50000 annually for most businesses 2 for financial institutions and mining companies and were not reduced to 1378 and 1853 respectively. Ad pdfFiller allows users to edit sign fill and share all type of documents online. The DOT has been ordered to refund to businesses the excess tax collected plus interest from the date of collection.

Businesses or individuals may pay its delinquent tax online using a credit card or debit. Forms and payments have to be mailed or hand delivered to one of the four district offices of the Nevada Department of Taxation. In late 2018 the required threshold was exceeded and the MBT rates were scheduled to drop effective July 1 2019.

The 31st Special Session of the Nevada Legislature enacted Senate Bill 3 which provides for a one-time tax amnesty program for businesses or individuals doing business in Nevada who may have an existing tax liability. Exceeding 62500 per quarter. Due to increased returns and payments received processing can take longer than normal.

This year the return is due August 14 2020. All forms and tax payments are due by the end of the month following the end of the four-month period. 1 and ends on May 1.

Under the sunset in AB. The Commerce Tax is based on a taxpayers Nevada gross receipts over 4 million earned from July 1 2019 through June 30 2020. Forms and payments must be mailed to the address below.

SignNow has paid close attention to iOS users and developed an application just for them. The Nevada Commerce Tax return is due 45 days following the end of Nevadas fiscal year which ended on June 30 2020. Total gross wages are the total amount of all gross wages and reported tips paid for a calendar.

Nevada modified business tax due dates by Jan 24 2021 cartoon concept science The 2011 Legislative Session pursuant to AB 561 eliminated the Modified Business Tax on any General Business with 62500 or less in taxable wages per calendar quarter after health care deductions. This two-tiered tax rate structure was scheduled to be effective for FY 2012 and FY 2013 only due to the June 30 2013 sunset in AB. Processing Dates - Paper Filings.

When Are the Forms and Tax Payments Due.

2022 Federal Tax Deadlines For Your Small Business

Free Nevada Payroll Calculator 2022 Nv Tax Rates Onpay

Biden Win Changes Tax Policy And Planning Outlook Grant Thornton

Fillable Form 10 381 Arkansas Duplicate Title Application Form Fillable Forms Registration

La County Well Permit Fill Online Printable Fillable Blank Pdffiller

Form Txr 021 05 Mbt Fi Download Fillable Pdf Or Fill Online Modified Business Tax Return Financial Institutions Nevada Templateroller